When your insurance denies your roof claim, immediate action is key. This guide provides a straightforward approach to what to do if insurance denied roof claim, delivering concise and practical advice to help you understand your policy, confront your insurer effectively, and explore additional options to secure the repairs you need.

Key Takeaways

- Understanding the specific reasons for roof claim denial, such as wear and tear, pre-existing damage, or policy exclusions, is critical to contesting the decision and seeking approval.

- Knowing the details of your homeowner’s insurance policy, including damage coverage types, coverage extent, possible exclusions, and deductible amounts, is essential to navigating a roof claim denial.

- To challenge a roof claim denial successfully, it’s important to gather strong evidence of the damage, understand the appeal process, and consider seeking professional opinions and legal advice if necessary.

Understanding Your Claim Denial: The First Step

When an insurance company denies your roof claim, it may feel like a crushing blow. But don’t despair. Resolving the issue begins by comprehending the reason for the denial. Common reasons for roof claim denial include wear and tear, pre-existing damage, or policy exclusions. Has your roof reached its expected lifespan? Was there a manufacturer’s defect in the roofing materials? Understanding these specifics can help you chart the best course of action when insurance denies your roof.

Bear in mind, that differing assessments by insurance adjusters may also culminate in a claim denial. Adjusters may lack expertise in roofing, leading to misunderstandings about the extent of the damage. Therefore, gaining an understanding of the specific reasons for your claim denial is crucial. It equips you with the knowledge you need to challenge the denial and explore other avenues to get your claim approved.

Evaluating Your Insurance Policy’s Specifics

When dealing with a roof claim denial, it’s necessary to comprehend the specifics of your homeowner’s insurance policy. Your policy outlines the types of damage covered, the extent of coverage, and any potential exclusions that might affect your roof insurance claim. For instance, dwelling coverage within homeowners insurance generally protects the structure of the house, including the roof, from a variety of perils, such as fire, wind, and hail.

However, certain perils might be excluded from your policy. For example, damage from windstorms and hail might not be covered, impacting the coverage of roof damages. Also, your policy might cover the entire roof replacement if partial damage significantly affects its lifespan. Comprehending these specifics becomes crucial in maneuvering through the insurance process and averting future claim denials.

Identifying Coverage Limitations

Insurance coverage limits are vital restrictions in insurance policies that define the extent, types, and conditions of coverage provided for roof repairs or replacements. For example, your policy might exclude certain perils or natural disasters, which can restrict or completely eliminate coverage for certain types of roof damage.

When tackling a roof claim, it’s fundamental to be cognizant of these limitations. If you’re aware of the limitations in your policy, you can take preventive measures or consider purchasing additional coverage. This awareness can save you from the shock of an unexpected roof claim denial and ensure you’re adequately prepared for any roofing issues that arise.

Clarifying Deductible Amounts

Another critical aspect of your insurance policy is the deductible – the amount you must pay out-of-pocket before your coverage kicks in. If the cost of roof repair is only slightly more than your deductible, filing a claim may not be financially advantageous due to potential hikes in future premiums.

Different types of claims may have higher deductibles than others under a homeowner’s policy. For instance, a claim for hail damage might have a higher deductible than a claim for fire damage. Comprehending your deductible and its impact on your claim can guide your decision to file a claim or not, thus ensuring a financially prudent decision.

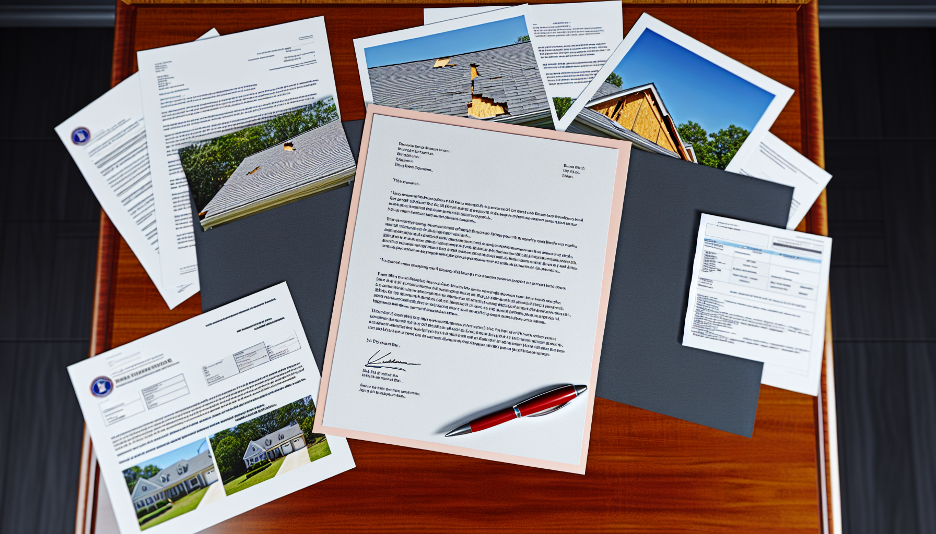

Gathering Evidence to Support Your Roof Damage Claim

Amassing robust evidence is a pivotal move in contesting your roof claim denial. This evidence can include high-quality photos and videos of the damage, ideally taken in well-lit conditions. Having a ‘before’ and ‘after’ comparison can be particularly beneficial in demonstrating the extent of the damage.

In addition to visual evidence, it’s also crucial to have an accurate estimate of the repair costs. Here are the steps you should take:

- Contact a roofing contractor for an inspection and accurate estimate that details the date of the storm and the extent of both roof and interior damage.

- Save all receipts for roof work and damaged property.

- Keep an inventory of items before and after the event to substantiate claims for reimbursement.

Navigating Communication with Your Insurance Adjuster

Communicating with your insurance adjuster can pose a challenge, particularly when grappling with a roof claim denial. The adjuster, as the insurance company’s representative, plays a crucial role in claim approvals. Thus, staying calm and polite when interacting with adjusters becomes imperative.

To effectively handle your insurance claim, follow these steps:

- Record all details of interactions with the adjuster, including names, contact information, and the specifics of conversations and emails. These records can be invaluable if you need to appeal the claim or take further legal action.

- Set boundaries on the frequency of phone communication to avoid being overwhelmed.

- Avoid immediate settlements. Take the time to fully understand the extent of the damage and consult with professionals if necessary.

- Decline to give recorded statements to prevent providing inaccurate information.

By following these steps, you can ensure that you handle your insurance claim in a thorough and effective manner, avoiding the possibility of having your insurance denied.

Seeking a Second Opinion: When to Involve a Professional

Should you find yourself at odds with the insurance company’s claim assessment, it could be time to seek an alternative perspective. Requesting another adjuster from the insurance company is a straightforward way to get a second opinion when there are disputes over the claim assessment. If your claim is partially denied, you have the option to request a re-evaluation from a new adjuster, which could lead to a more favorable settlement.

Having a reputable roof repair contractor present during the re-inspection process provides documentation and an expert opinion that can influence the claim review. An experienced roofing contractor or a public adjuster acting as a third-party representative during the inspection can supply additional supporting evidence for the claim.

Hiring a Roofing Expert

Engaging a reliable roofing contractor could significantly alter the course when contending with a roof claim denial. A contractor can point out damages and explain why they should be covered by insurance during the roof inspection by the insurance adjuster. Moreover, using a GAF MasterElite Certified roofer to install or repair your roof can provide exclusive warranties and ensure proper installation, which is often required for warranty validity.

In cases where insurance adjusters are unreasonable, hiring a structural engineer to inspect the roof can be instrumental in substantiating a roof claim. Employing a roofing expert provides homeowners with peace of mind, knowing that their roofing project is competently handled and their investment is effectively protected.

The Role of Independent Insurance Adjusters

Independent and public adjusters fulfill different functions in the insurance claims process. Independent adjusters are contracted by insurance companies for impartial assessments, while public adjusters are hired by policyholders to advocate for their interests in the claim. These professionals offer unbiased evaluations, ensure fair representation of claims, and aim to help homeowners receive appropriate compensation for their losses.

Independent insurance adjusters specialize in accurately identifying damages and recommending fair settlement amounts, which can be pivotal in claim disputes when original insurance assessments are contested. On the other hand, public adjusters serve as advocates for policyholders, offering personalized service that includes verifying coverage, documenting losses, and negotiating settlements to increase the success rate of insurance claims.

Exploring the Appeal Process for Denied Roof Claims

Don’t despair if your roof claim has been denied. There’s a possibility to contest the decision. by writing a formal letter articulating your dispute reasons and explaining your position in detail. Strengthen your appeal by including supporting documentation such as photos, repair estimates, and relevant policy excerpts with your appeal letter.

In the appeal letter, set a resolution date to request the insurance company to respond by a specified deadline, ensuring the process moves forward in a timely manner. It’s important to understand that the appeal timeframe varies by the insurance company and state, so ensure all appeals are filed within this specific window to avoid forfeiting the right to appeal.

Legal Recourse: Taking Further Action After Claim Denial

Should your appeal fail, contemplating legal recourse could be the next step. Consulting with an attorney who specializes in insurance law may be necessary if there is suspicion of bad faith by the insurance company. Hiring a qualified attorney with specific expertise in property insurance claims is recommended to ensure proper litigation against the insurance carrier; it’s important to check the attorney’s track record in settling property insurance claims.

An insurance claims attorney can assist in negotiations with the insurance company, support during the appeal process, and ensure fair coverage of losses in any settlement offers. Alternatively, filing a formal complaint with the state’s insurance commissioner is an option when there is a belief the insurance company has not processed the property claim fairly or in good faith.

Financing Options for Roof Repairs or Replacement

Confronting a roof claim denial can pose financial difficulties, particularly if immediate roof repair or replacement is necessary. Thankfully, several financing options are available, including:

- Personal loans: These can provide quick, lump-sum funding for roof repairs.

- Home renovation loans: Options like FHA 203(k) or Fannie Mae HomeStyle may offer more borrowing power based on post-upgrade home value.

- Home equity loan or HELOC: If equity is available in the home, this can be a cost-effective way to finance a new roof, with potential tax benefits.

On the other hand, credit cards can offer a quick financing solution, though interest rates can be high if the balance isn’t paid off before the promotion ends. Roofing companies may also offer in-house financing plans that can simplify the process and suggest the company’s credibility. Understanding these options can help you make an informed decision and ensure your roof gets the necessary repairs or replacement without breaking the bank.

Preventing Future Claim Denials

The most effective method to tackle a roof claim denial is by preventing its occurrence in the first instance. Here are some steps you can take to prevent insurance claim denials related to lack of maintenance:

- Regularly inspect your roof and perform necessary repairs. This involves inspecting shingles and flashing annually, as well as cleaning gutters regularly.

- Address roofing issues promptly. Don’t wait for small problems to become big ones.

- Adhere to the manufacturer’s specifications for repairs and maintenance. This ensures that your roof is being properly cared for. By following these steps, you can prevent claim denials based on negligence or improper care of the roof.

Understanding the expected lifespan of your roof material and ensuring replacement before it is past due can help avoid claim denials based on the age of the roof, with regular maintenance being a stipulation in many roofing warranties. By taking these preventive measures, you can protect your home and your investment and avoid the stress and hassle of dealing with a roof claim denial.

Summary

Navigating the process of a roof claim denial can be daunting, but armed with the right knowledge and strategies, you can successfully challenge the denial and secure a fair settlement. Understanding your insurance policy, gathering strong evidence, maintaining effective communication with insurance adjusters, and seeking professional help when necessary are all crucial steps in this process. Remember, if your appeal is unsuccessful, legal recourse is available. Finally, preventative measures such as regular roof inspections and maintenance can help you avoid future claim denials. Armed with this knowledge, you are now better prepared to navigate the complexities of roof claim denials.

Frequently Asked Questions

In what circumstance would a property insurance claim be rejected?

A property insurance claim may be rejected due to policy exclusions or insufficient documentation from the policyholder. It’s crucial to meet the maintenance requirements and take necessary precautions to prevent damages, as negligence could lead to claim rejection.

How do home insurance companies determine pre-existing damage?

Home insurance companies determine pre-existing damage through a combination of visual inspections, historical property records, and expert evaluations, which can be complex and time-consuming. It’s important to note that some insurance policies may exclude coverage for pre-existing damage altogether.

Is a leaking ceiling covered by insurance?

While home insurance can cover the cost of repairing a ceiling damaged by a sudden and accidental leak, it may not cover the source of the damage, such as plumbing backups or aging roofs needing replacement. It’s important to review your policy and understand what is covered.

What are common reasons for roof claim denial?

Common reasons for roof claim denial include wear and tear, pre-existing damage, and policy exclusions such as specific perils or natural disasters. Be sure to review your policy to understand the coverage.

What is an insurance deductible?

An insurance deductible is the amount you must pay out-of-pocket before your coverage starts. It’s important to understand how it applies to your policy.